5 Best Brokers for Commodities & Futures Trading year

Contents:

The mobile user experience will play a big role in how successful you are trading commodities. The better the user interface, the more informed you’ll be when making trading decisions and the more quickly you’ll be able to place trades. The Thinkorswim app comes packed with over 100 technical studies and indicators, customisable drawing tools, flexible alerts, and more.

Many programs offered diversified, non-stock market correlated programs to best suit your investment goals. Similar to robo-advisors, our automated trading systems take the guess work out of investing in commodity futures. Opening an account and depositing is easy, and you can even try it out with virtual money . The only currency accepted is the USD, which means that you’ll be charged currency conversion fees upon deposit and withdrawal if you deposit in another currency. BUX Zero is an online broker offering commission-free stocks and ETFs trading.

Market Data & Economic Analysis

There are multiple delivery months available on futures contracts. NinjaTrader only uses these higher initial and maintenance margins for positions held overnight, which is very appealing for active traders. TD Ameritrade is now acquired by Charles Schwab as of October 2020, though TD Ameritrade is still operating as a standalone commodity broker at this time and the two companies aren’t fully integrated yet. Many like TD Ameritrade’s trading platform, Thinkorswim, which helps facilitate trades for futures, options, and other asset classes and investment choices. Trading commodities via CFDs enables traders to speculate on the price of commodities with leverage.

The costs are typically in the $0.10-$0.25 / trade and contract range. Traders who are uncertain what financial product they will finally trade consider TradeStation. The costs are higher compared to Optimus Futures and NinjaTrader Brokerage, but traders can also trade stocks and options besides futures from one account.

Low Day Trading Margins

Futures are a highly liquid market, but there are times when this isn’t the case. Our CFD futures markets, however, remain highly liquid at all times thanks to our large number of clients and our technology – a smoother trading experience even on larger trades. Our trade desk and customer service reps are available any time that the futures markets are open and have an average of over 10 years futures experience each. In Trading 212, you will findcommission-free stocks and ETFs trading, fractional shares, and even an automatic investment system (Robo-advisor). On the downside, it shows limitations regarding available products, such as the lack of bonds and options.

NinjaTrader’s futures trading fees are a little high compared to competing futures trading platforms, but it makes up for it with the variety of investment options for traders of all calibers. Active traders who are testing the waters can take advantage of NinjaTrader’s trading simulator and library of video guides, while the adept can harness their charting and technical analysis resources. Experienced traders will find NinjaTrader intuitive and easy to use, but the platform will hold your hand if you’ve never traded futures before. Traders can trade nearly every investment product with IB for a low discounted price, including trading futures globally on over 30 market centers. Commissions per futures contract start at $0.85, and sophisticated traders can take advantage of powerful futures trading tools, including ComboTrader, SpreadTrader and Index Arbitrage Meter.

While each best commodity brokers has its own trade fee structure, your broker will attach a commission for placing the trade as well. Like with any futures broker, the commission is only one part of the fees because the transaction feeds for the exchange, clearing and order routing need to be added. AMP offers one of the lowest commission rates in the industry, but instead of directly offering a quote on their site, they advertise to match or beat any commission rate from other brokers. That means that a user has more work since it needs negotiation instead of having a clear offer. One of the first things to compare among commodity brokers is the cost and fees that they’ll charge.

No overnight funding fees

The best forex broker for trading indices is IG, as they offer a large market range with competitive pricing. The most profitable commodities are characterized by high liquidity and volatility. So, the best commodities to invest in or trade include natural gas, crude oil, and spot metals. The term commodity is used to describe raw materials, extracted minerals, or agricultural outputs. They are bought and sold on the spot market or act as the basis of other derivatives markets such as the futures market.

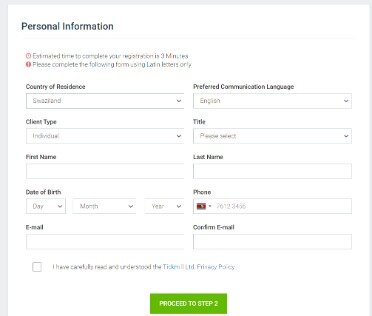

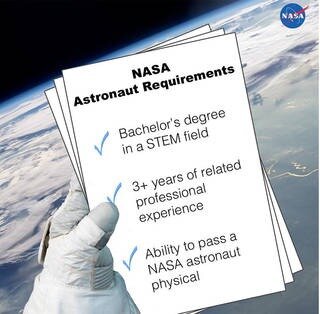

Major factors in determining the quality of a broker’s offer include the cost of trading, the range of instruments available to trade, and general ease of use regarding execution and market information. A commodities futures broker will provide access through futures trading to commodities exchanges such as the CME or CBOT. Our guide on how to trade futures explains the risks and rewards of futures trading. To get started, open an account with a broker that supports futures markets. The broker will probably ask about your net worth, your investing experience, and how much money you make.

Overview of Trading Platforms

Although futures are traded mostly by institutional investors, retail investors can also speculate by using a futures trading platform. The regulatory body in the U.S. that oversees futures trading is the National Futures Association . The traditional way to trade commodities is by using futures contracts.

Paper trading is a practice that involves opening and closing positions on an online trading platform with no real money at risk. Another important thing that you should consider when selecting a futures trading platform is how much money they charge per month or year depending on their terms and conditions. There are some companies that charge very little while other companies charge more than average so it’s important that you find one that suits your needs and budget. Futures trading is one of the most popular ways to trade, but it can also be one of the most complicated. For example, if you’re just starting out, you may not know what type of futures contracts to trade or where to find them. Futures trading is the use of financial markets to control risk in a specific situation.

E*TRADE From Morgan Stanley Recognized as #1 Online Broker for … – Business Wire

E*TRADE From Morgan Stanley Recognized as #1 Online Broker for ….

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

Equity investing is more long-term, as traders may hold stocks or ETFs for several years. Purchasing futures is also considered a short-term trading strategy. Similarly, trading commodity CFDs is more short term and devoid of various expenses & stick requirements.

Livestock Commodities

It is available in over 50 countries and is listed on the London Stock Exchange. Founded in 2006, eToro is a well-known worldwide fintech startup and the leader in the social trading field (follow other people’s trades), with over 30 million users worldwide. You can also invest in other products through their platform, which is intuitive and simple to use, making it a good choice for beginners. Plus, eToro offers commission-free stock trading in the Netherlands. Plus500 is a multi-asset online broker that offers no commissions when trading CFDs in Indices, Forex, Commodities, Cryptocurrencies, Shares, Options, and ETFs.

Another method of investing in commodities is to invest in the stock of companies that are related to the commodity you wish to invest in, in some way. Examples of this are investing in the stock of oil companies or agricultural companies. Energy commodities are crude oils, heating oils, gasoline, and natural gasses. Oil prices have increased due to the reduced oil outputs and an increase in demand. Investors, who want to invest in the markets but do not have the resources to buy each individual stock, can use stock indexes as a way to diversify their portfolio.

- If a client is looking for a superior futures trading platform or expert-level customer service from discount futures brokers, Cannon Trading is here to help.

- Let’s go over some of the top features to keep in mind when looking for the best commodity broker.

- The margin requirement is typically a percentage of the value of the underlying asset that each contract controls.

- We have account plans perfect for theinvestor new to futures trading or seeking assistance with their futures trading.We provide the tools and training to become a better-informed futures trader.

- This allows you to take advantage of small price movements in the underlying asset without taking too much risk.

The discussion was centered around precious metals https://trading-market.org/, the impact of the currency market on commodities, and Bitcoin. The topics covered were the precious metals futures, a crude oil rally and collapse, and the US Dollar Index futures contract. Technical analysis performed by futures broker, Carley Garner, and presented on Mad Money by Jim Cramer suggest gold still shines brighter. If brokers and commission just get in your way, this is the plan for you. The Pro plan is reserved for those with ample account funding and trading experience to require minimal broker attention.

Intraday trading is often taken as a full-time job, as it requires traders to be engaged throughout the trading day. An option gives you the right, not the obligation, to buy or sell a futures contract at a strike price before a particular date. When you buy options you can take either a long or short position and speculate on whether its value will increase or decrease. Traders may choose to trade futures because it can give them a strong position without having to pay a lot of cash. Investors may either buy an asset with the hope that it increases in value in the future, or short-sell with the hope that the price decreases later. The broker offers fast execution, no re-quotes and spreads starting from as low as 0.0 pips.